Guide to Choosing a Payment Gateway for your E-Commerce Store

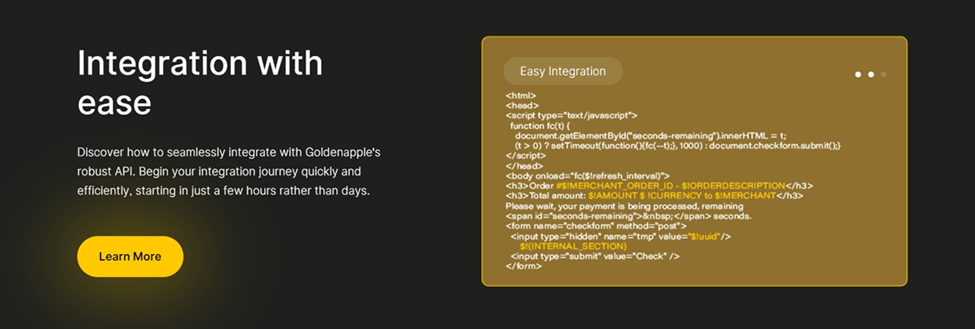

Each payment gateway shares a common purpose. However, it’s crucial to recognize that they vary in quality and features. When your business is in the process of selecting or transitioning to a new payment gateway like Goldenapple, it’s essential to keep some important factors in mind. These considerations will play a pivotal role in ensuring a seamless and efficient financial transaction process for your business.

It Should Offer High Quality Customer Support Services

Evaluate the available support services carefully in order to guarantee a comfortable and effective partnership with your chosen payment gateway, whether it is Goldenapple or any other service. It is imperative to assess the level of support you would receive, including dedicated technical and customer support that aligns with your time zone and language preferences.

Alignment with your Preferred Time Zone

Confirm that the payment gateway’s support services operate within your business hours. Having assistance available during your operational times ensures swift issue resolution and minimizes downtime.

Training Resources Matter

Check if the payment gateway provides training resources for your team. Access to educational materials can empower your staff to handle routine queries independently, reducing the reliance on support services for common issues. Goldenapple is among a select few platforms out there that offer reliable educational material.

Availability of the Right Support Channels

Assess the variety of support channels available, such as live chat, email, or phone support. A diversified set of communication options allows you to choose the most convenient method based on the urgency and nature of the issue at hand.

Fast Response Time Is a Must

Inquire about the expected response time for support inquiries. A prompt response is essential in critical situations, ensuring that any disruptions in payment processing are swiftly addressed and resolved.

Language Compatibility

Opt for a payment gateway that provides support in your preferred language. Clear communication is pivotal in addressing concerns promptly and efficiently, enhancing the overall experience for both your team and customers.

Dedicated Technical and Customer Support Teams

Prioritize gateways like Goldenapple Cyprus that offer dedicated technical and customer support teams. Having specialists familiar with your business intricacies can expedite issue resolution and provide tailored assistance, contributing to a smoother operational process.

By carefully considering these aspects of support, you ensure that your business has a reliable and accessible partner in your payment gateway. This proactive approach creates a sense of confidence in your payment processing capabilities but also contributes to a smoother and more efficient operational workflow.

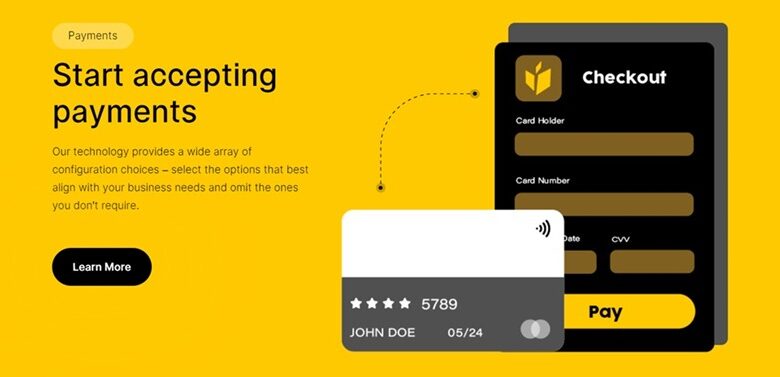

The Gateway Must Provide Value Added Services

It is vital to explore the value-added services offered by potential payment gateways like Goldenapple to enhance decision-making and facilitate business growth. Beyond the core transactional functions, consider additional services such as data analytics, fraud detection, and risk management.

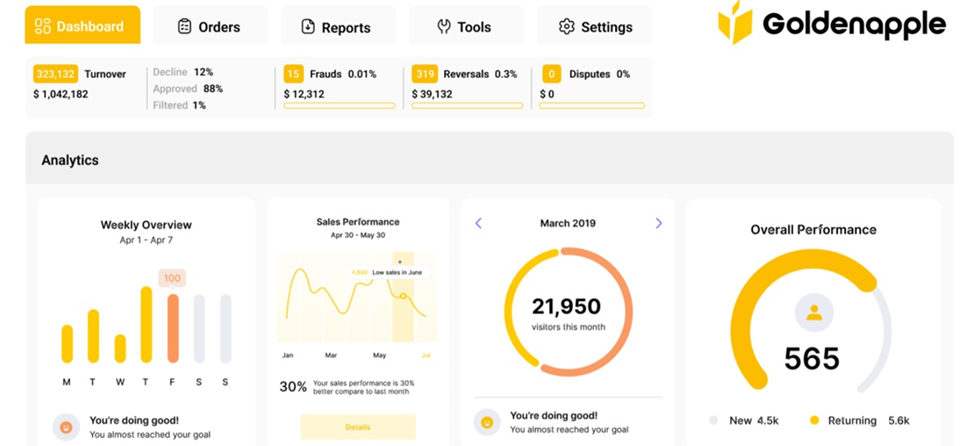

Why Data Analytics?

Opt for a payment gateway that provides robust data analytics tools. Analyzing transaction data can offer valuable insights into customer behavior and trends. This data-driven approach empowers your business to make informed decisions, optimize marketing strategies, and enhance the overall customer experience.

Fraud Prevention

Prioritize gateways equipped with advanced fraud detection and prevention mechanisms. Proactive measures against fraudulent activities protect your business and instill confidence in your customers. Look for features like real-time transaction monitoring, machine learning algorithms, and customizable fraud rules to tailor the system to your specific needs.

Inquire About Settlement Speed

When evaluating potential payment gateways, inquire about the speed of settlement and the specific terms regarding fund distribution, as these factors can significantly impact your business’s cash flow. Here are key questions to pose:

What are the Settlement Times?

Seek clarity on the settlement times offered by the payment gateway. Understanding how quickly funds will be deposited into your account is crucial for maintaining a healthy cash flow. Inquire about both standard and expedited settlement options, if available.

Learn about Gross or Net Settlement

Clarify whether funds are settled gross or net of fees and charges. Gross settlement involves transferring the total transaction amount before deducting fees, while net settlement deducts fees before depositing funds into your account. Knowing the settlement method helps you accurately anticipate the actual revenue received and manage financial planning effectively.

Ask About Fee Transparency

Request detailed information on all applicable fees and charges associated with the settlement process. Transparent fee structures allow you to accurately assess the financial implications of each transaction and make informed decisions regarding the choice of payment gateway.

Currency Considerations are Also Important

If your business operates in multiple currencies, inquire about the gateway’s capabilities regarding currency conversion and settlement. Understanding how foreign exchange rates are applied and how multi-currency transactions are settled ensures clarity in cross-border transactions, something that Goldenapple is ideal for.

*Add Hyperlink within/inside the image – https://goldenapple.com.cy/

Final Thoughts

By carefully evaluating the factors discussed in this piece, you not only ensure a reliable and accessible partner in your payment gateway but also contribute to a smoother and more efficient operational process. This proactive approach instills confidence in your payment processing capabilities and lays the foundation for long term business growth.